Bear with me as this is my first ever real blog post. Usually, I just submit a link to an article or quote with a few words on my FB wall; but this year, at the request of many of my close friends, I will try to expound on thoughts, themes, and trends I’ve been noticing over the past few years.

One topic that has been coming up on the web is about Millennials and their view of the future.

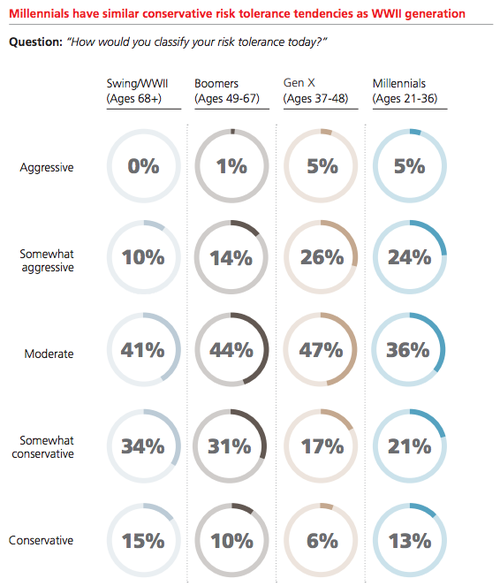

UBS Wealth Management released a report this quarter about how Millennials view investing, finances, and success. Though much has been written by bloggers and pundits about what this mysterious generation thinks, wants, or does - the common theme in terms of investing and prospects for the future can be summed up as: “wary” or “conservative”.

This generation, currently between the ages of 21-36, has weathered an major financial crisis as they have entered the workforce. They’ve either seen offers rescinded, depressed wages, or had to witness their parents’ financial difficulties. The Millennial generation is also a generation that were in their teens when the war on terror began on 9/11/2001. So for a large part of their early adulthood, they’ve experienced a world so volatile and dangerous that is has shaped a much different view of the future than previous generations at their age.

Though the Baby Boomers and WWII generation (aka The Greatest Generation), experienced immense societal upheaval and discord; it is the Millennial generation that has been through relatively difficult events in an era of rapid technological development and adoption. Millennials are definitely standing on the shoulders of previous generations, but as they do and with more information at their fingertips their views on life, success, and wealth are quite different.

Take for instance that Millennials are the most indebted generation with over USD $1Trillion in student loans and as of November 2013, 7.3% unemployment rate. Given this information, coupled with the aforementioned experiences with a world in turmoil and conflict, it’s not surprising the results of the UBS report, outlined below:

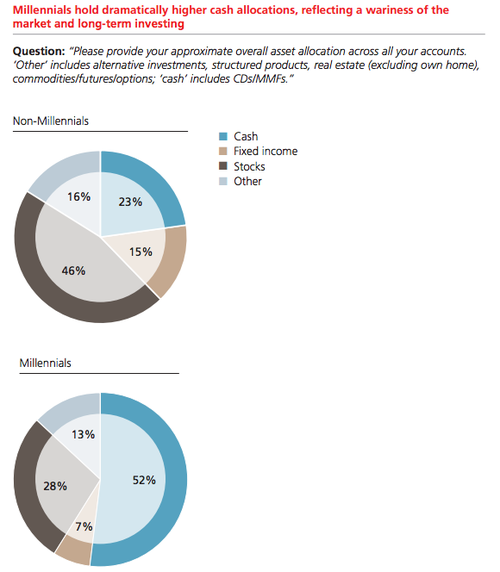

This increase in Cash and decrease in Stocks, correlates with some other research I’ve come across about the nature of individual investors post-Great Recession. The fact is that though the markets have been soaring in the past few years since the Crash, the number of individual participants has remained low. Valuations have been up, but unemployment still is weighing on growth (Q4 2013 GDP Figures just came in at 3.2% and 1.9% for all of 2013).

Another reason is that Millennials are extremely distrusting of corporations since the Crisis revealed so many shady and unethical practices by major banks and corporations. This is a generation that will not choose to work for an employer based on their social impact and policies.

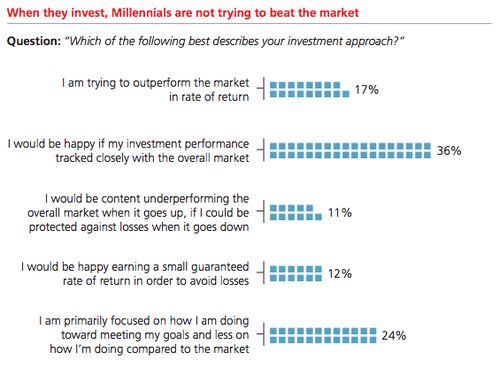

Their financials ambitions with the market and investing have been tempered and made more realistic.

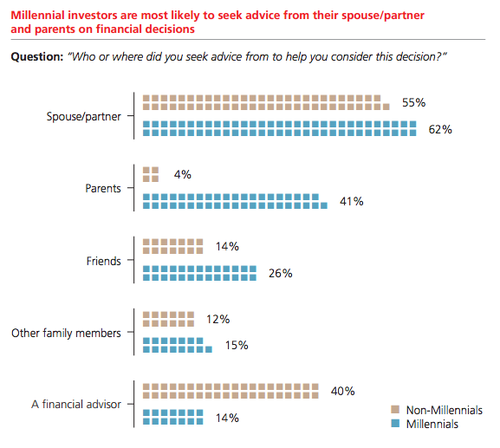

And their distrust of 3rd Party advisors is apparent. They prefer advice from trusted recommenders.

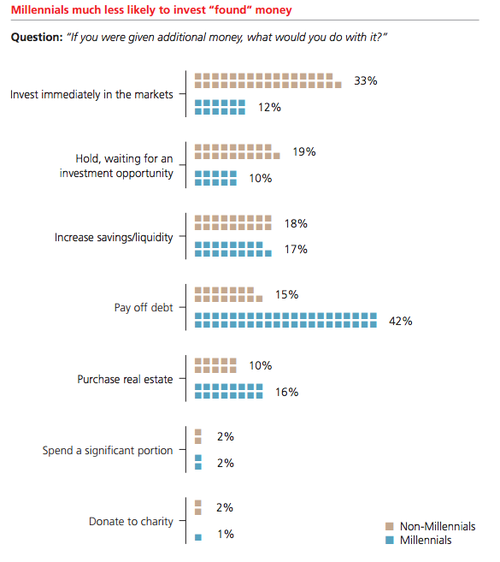

As the probably the most indebted generation, the answer to this survey question is no surprise.

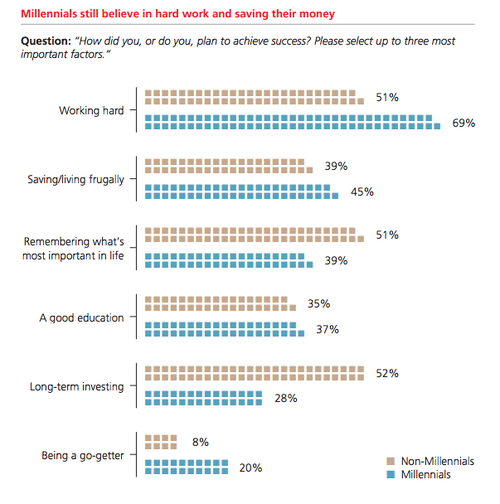

And because they’ve seen many people’s life-savings and 401K’s decimated, they know they have to put in the time and effort to be successful. Recently, I read that this is also one of the most frugal generations - I’m sure that is debatable, but I can see merits of that argument given the answers to the next question about Definition of Success.

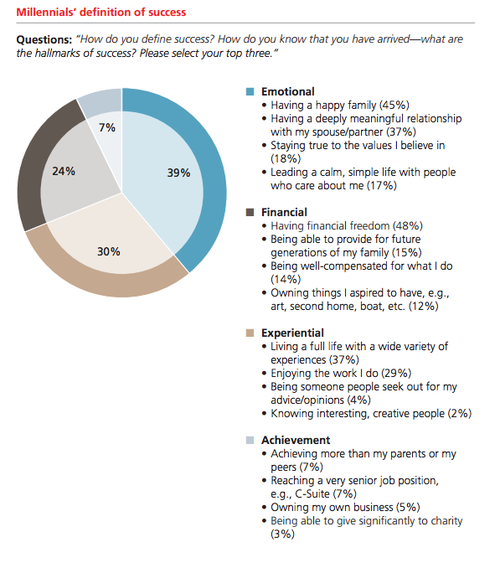

It seems all the events from the 90’s to now, witnessed by Millennials, has made them ambitious, but shaped their worldly pursuits to be less materialistic and more experiential and intangible. Emotional Well-Being tops the list, followed by Experiential pursuits, with Financial success coming in a significant 3rd.

This all makes sense. There certainly are those that want to pursue a Gordon Gekko life-style, but ultimately, as we are speaking in vague terms of generations, these Millennials seem to need financial wealth only to live a full life. When asked what income is considered successful, Millennials averaged $220K, which was pretty close to each of the other generations which ranged from $205K to $256K. It is unclear if this was inflation adjusted, but let’s assume so. When asked what income would make them notably happier, all other generations came in at around USD $2M, while Millennials overwhelmingly (80%) stated USD $1M.

Given their conservatism as highlighted in the UBS charts, these figures about well-being and wealth definitely suggest that Millennials are driven by the quality of their assets as opposed to their quantity. In addition, they are redefining what assets mean to them to include happiness factors such as a good home, strong relationships, and trying out different paths. This last part is evident at any Millennial resume you read - it’s unlikely folks in this generation will keep a job for more than two years.

I happen to be at the cusp of the Millennial generation, so some of UBS’ finds don’t surprise me at all. And while I can’t speak for my whole generation, I can say that I’m excited to see how we will impact our world.

Of course, much of the Millennial reports and surveys mostly target the US population, but from all my travels, I’ve seen many of these trends translate well in other cultures. In emerging markets like India and China, where choice in educational path, growing middle classes, and increased access to information, have all brought similar opportunities and social shifts. I’ve also seen a more tolerate and activist generation across Eastern Europe, the Middle East and Africa, where I had the opportunity to serve in United Nations Peacekeeping Missions.

Let’s see what happens with this generation.